The SEC aims to dismiss claims against Ripple CEO Brad Garlinghouse and executive chair Chris Larsen in their ongoing lawsuit.

Key Takeaways:

- Lawyers representing the SEC have requested the dismissal of claims against Ripple CEO Brad Garlinghouse and executive chair Chris Larsen.

- The SEC’s move follows an ongoing civil lawsuit against Ripple, initiated in December 2020.

- Ripple’s legal officer characterizes the SEC’s action as a “surrender” rather than a settlement.

- A federal judge had previously ruled that XRP was not a security when sold to retail investors.

- Speculation arises on why the SEC chose to drop the charges before the trial, with implications for the XRP classification as a security.

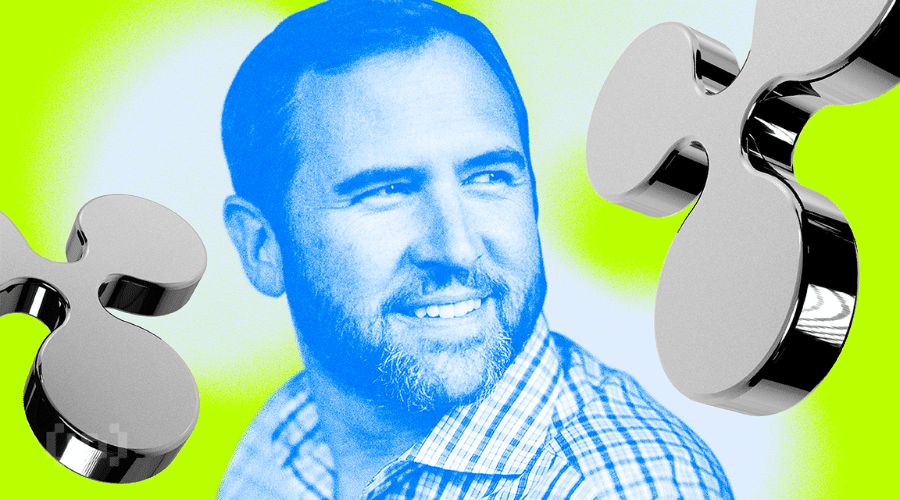

In a surprising turn of events, lawyers representing the United States Securities and Exchange Commission (SEC) have announced their intention to seek the dismissal of all claims against Ripple CEO Brad Garlinghouse and executive chair Chris Larsen. This announcement was made through a filing submitted to the U.S. District Court for the Southern District of New York on October 19, 2023.

Dismiss Lawsuit

The SEC’s filing stated that the parties involved in its case against Ripple “have stipulated to the dismissal with prejudice,” indicating that there was no need to schedule a forthcoming trial. However, it’s important to note that the SEC did not indicate any plans to drop its civil case against Ripple itself, which was initially filed in 2020.

According to the filing, both the SEC and Ripple plan to collaborate on establishing a potential briefing schedule regarding the pending issue in the case—specifically, the appropriate remedies against Ripple for its Section 5 violations related to its Institutional Sales of XRP. They have respectfully requested until November 9, 2023, to propose such a schedule to the Court or, if no agreement is reached, to seek a briefing schedule from the Court through a contested process.

In response to the SEC’s move, Ripple’s chief legal officer, Stuart Aldeorty, characterized it as “a surrender by the SEC” rather than a settlement. Ripple issued a statement describing the SEC’s decision as a “stunning capitulation.”

It is funny that the SEC tries to use pending litigation as a reason to appeal.

The SEC mocked the judges by dropping the lawsuit on Coinbase a week before Ripple summary judgment. The SEC knew they should have waited until after summary judgement. The SEC put the carriage… https://t.co/vX9VEajcrg pic.twitter.com/RStC5FpY3O

— Wen Moon (@WenMoonTok) August 10, 2023

Brad Garlinghouse also weighed in, stating, “Chris and I were targeted by the SEC in a ruthless attempt to personally ruin us and the company so many have worked hard to build for over a decade,” in an Oct. 19 post on X (formerly Twitter).

This legal saga began in December 2020 when the SEC filed a lawsuit against Garlinghouse, Larsen, and Ripple, primarily concerning the sales of XRP tokens, which the SEC had also claimed to be securities. In July, a federal judge ruled that XRP was not a security when sold to retail investors.

The SEC’s decision to drop the charges against Garlinghouse and Larsen raises questions about the commission’s strategy, as a trial was scheduled to commence in April 2024. Katherine Kirkpatrick, the chief legal officer of Cboe Digital, speculates that this move could indicate the SEC’s intention to appeal the court’s decision on XRP’s security classification, which might have had to wait until the conclusion of the trial.

To Conclude

The SEC’s unexpected move to dismiss claims against Ripple’s top executives marks a significant twist in the ongoing legal battle. This decision has left the crypto community pondering the implications for Ripple’s status and the broader cryptocurrency landscape. The SEC’s future actions and Ripple’s response will undoubtedly be closely watched by industry participants and observers alike.