Justin Sun becomes the largest individual Ethereum staker with 282,796 ETH; raised eyebrows with ETH withdrawals, and reveals a decade-long Bitcoin holding with Huobi.

Key Takeaways

- Justin Sun, Tron’s founder, stakes his claim as the largest individual Ether staker.

- Sun’s tagged wallet holds approximately 282,796 ETH, staked via the Lido platform.

- Lido Finance recently implemented a Staking Rate Limit following its largest-ever ETH inflow.

- In a transparency move, Sun disclosed that his Bitcoin holdings have been with Huobi exchange for a decade.

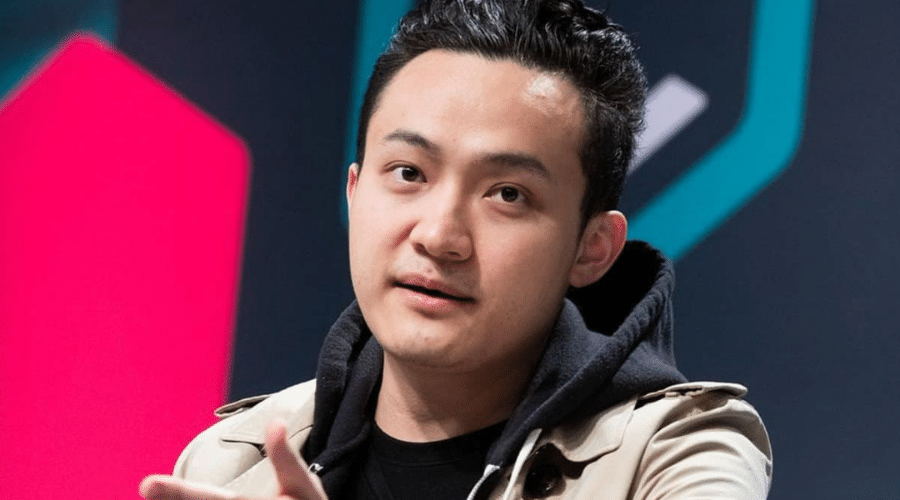

In the ever-shifting landscape of cryptocurrency, Justin Sun, the high-profile founder of the Tron blockchain protocol, has reportedly emerged as the most substantial individual staker of Ethereum (ETH).

Renowned crypto journalist Colin Wu highlights that the wallet associated with Sun boasts a staggering 282,796 ETH — valued at roughly $447 million at press time — staked through the Lido platform.

The address tagged Justin Sun is probably the largest individual ETH staker. The two address tagged Justin Sun currently has 282,796 ETH ($439M) staked on Lido. According to @EmberCN

– 0x176f3dab24a159341c0509bb36b833e7fdd0a132 (192,656 ETH)…— Wu Blockchain (@WuBlockchain) October 15, 2023

Sun Drew Some Eyes

Earlier this month, Sun drew attention when he unstaked a significant sum, precisely $32.4 million worth of ETH. He didn’t stop there; on October 4, he proceeded to withdraw 19,999 staked ETH from Lido Finance, subsequently transferring them to the Binance exchange.

This move sparked speculation that Sun might have liquidated or intends to liquidate these digital assets.

The Lido platform, where Sun’s sizable ETH holdings are staked, made headlines in early 2023. It initiated a Staking Rate Limit security feature after experiencing an unprecedented daily inflow of 150,000 ETH.

This mechanism set a cap on the volume of Staked Ether (StETH) that could be generated based on the deposits received over the preceding 24 hours. Notably, Sun was already a prominent staker at the time, with over 150,000 ETH in his portfolio.

In a separate revelation, Sun disclosed that he had been entrusting his Bitcoin (BTC) stash to the Huobi cryptocurrency exchange for the past ten years, emphasizing his confidence in the platform’s security protocols.

He claimed to have had control over an impressive cache of more than 100,000 bitcoins.

Concluding Thoughts

Justin Sun’s strategic moves in the crypto arena underscore the intricate dynamics of individual and institutional participation in staking, particularly in Ethereum’s context.

The introduction of mechanisms like Lido’s Staking Rate Limit exemplifies how platforms are adapting to manage liquidity, security, and stability amidst surging participation.

Furthermore, Sun’s transparency about his asset storage strategies shines a light on the trust placed in longstanding crypto exchanges. It also prompts a broader discussion on the perceived security and risks associated with various storage methods in the crypto ecosystem.

While staking large sums presents opportunities for network participation and potential yield, the movements and decisions of influential individuals like Sun also have the power to impact market sentiment and dynamics significantly.