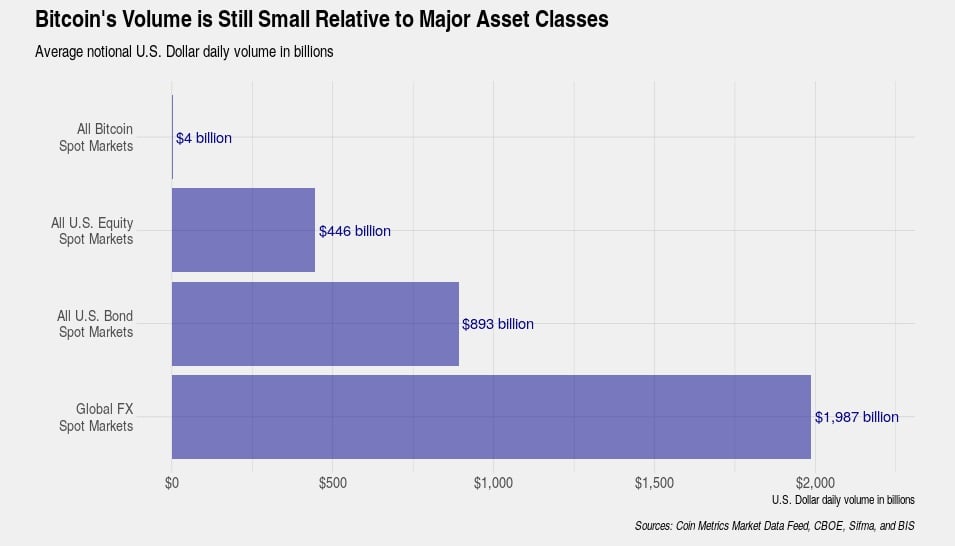

Bitcoin’s trading volume has experienced exponential growth which could reach levels similar to major asset classes, according to a new report by Coin Metrics. The cryptocurrency’s daily volume could exceed that of all U.S. equities in less than four years and all U.S. bonds in less than five years, the analysis shows.

Bitcoin’s Volume Growth Could Match Stocks and Bonds

Cryptocurrency data provider Coin Metrics published its new State of the Network report (Issue 53) Tuesday that focuses on analyzing bitcoin’s trading volume. Coin Metrics estimates bitcoin’s free-float market capitalization to be $136 billion — a size similar to the largest publicly traded companies in the U.S. However, the report notes that while it is easy to estimate bitcoin’s market capitalization, a volume assessment is “more complicated and different calculation methodologies can yield significantly different results.”

The report proceeds to suggest that any institutional investors wanting to enter the crypto space need to make some decisions that “can have a material impact on [the] evaluation of [bitcoin’s] trading volume and liquidity.” They include deciding which exchanges, markets, and cryptocurrencies they feel comfortable investing in, as well as whether to invest in stablecoins, such as tether (USDT), or crypto derivatives. Nonetheless, Coin Metrics concluded that regardless of these decisions:

All facets of bitcoin’s trading volume have experienced exponential growth and, if sustained, will grow to levels similar to major asset classes.

The Coin Metrics analysis compares bitcoin’s spot trading volume to that of other asset classes. Since its daily trading volume is only about $4.1 billion currently, the report asserts that bitcoin is “most comparable in size to a large capitalization stock rather than a distinct asset class.” Emphasizing growing volume, the report claims:

If historical growth rates can be maintained, however, bitcoin’s current daily volume from spot markets of $4.3 billion would need fewer than 4 years of growth to exceed daily volume of all U.S. equities. Fewer than 5 years of growth are needed to exceed daily volume of all U.S. bonds.

Ways to Determine Bitcoin’s Trading Volume

There are several ways to determine bitcoin’s daily trading volume, depending on what is included; each way yields a different volume number. An easy way is the $0.5 billion per day trading volume of bitcoin spot markets quoted in U.S. dollars from major exchanges, the report details, adding that most BTC trading occurs on a handful of centralized exchanges.

For this State of the Network report, the volume figures came from Binance, Binance US, Bitfinex, Bitflyer, Bithumb, Bitmex, Bitstamp, Bittrex, Bybit, Cex.io, Coinbase, Ftx, Gate.io, Gemini, Huobi, Itbit, Kraken, Liquid, Okex, Poloniex, and Upbit. About 90% of the volume of U.S. dollar quoted spot market volume is concentrated in four exchanges: Coinbase, Bitstamp, Bitfinex, and Kraken.

Bitcoin’s daily trading volume is much higher when including fiat markets, stablecoins, and derivatives. The volume jumped to $1.2 billion when including fiat markets, with the U.S. dollar representing about half of the total. The other major fiat quote currencies are the Japanese yen, the euro, the Korean won, and the British pound.

When including stablecoins, which have increasingly gained trading volume and market share, the analysis finds:

Including markets quoted in stablecoins significantly increases the daily trading volume to $3.5 billion, primarily due to tether.

Meanwhile, “The largest increase is observed when derivatives markets are added to the mix,” the report continues, noting that like other asset classes, “derivatives markets in bitcoin are several times larger compared to spot markets.”

What do you think of bitcoin’s trading volume growth? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coin Metrics

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer