In recent developments, U.S. Federal prosecutors have charged KuCoin and its two founders with violations of anti-money laundering laws. This move underscores the ongoing regulatory challenges within the cryptocurrency sector.

The allegations against KuCoin involve operating in the United States without proper registration and misleading investors about its operations there. Additionally, the company is accused of not maintaining an adequate anti-money laundering program.

Despite these hurdles, CEO Johnny Lyu remains optimistic, stressing that the issues KuCoin faces are not unusual but rather typical of the growing pains experienced by emerging industries. He pointed out that regulatory discrepancies are common in the nascent stages of industries like cryptocurrency. Lyu’s stance suggests a commitment to navigating the complexities of compliance as the sector evolves.

Optimism Amidst Market Unrest

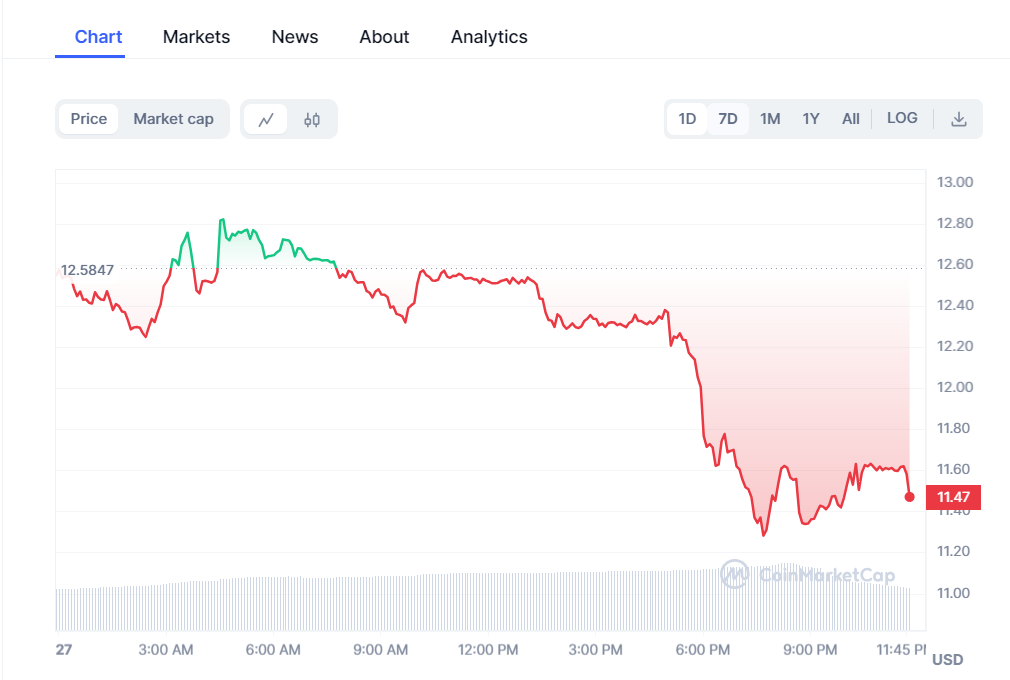

Despite the legal challenges and the resulting market uncertainty that saw KuCoin’s token value drop by over 17% in a single day, there’s a silver lining. CryptoQuant founder Ki Young Ju offered an optimistic view, noting that KuCoin seems to be operating as usual despite the panic.

On-chain data indicates a spike in Bitcoin and Ethereum withdrawals, mainly by retail investors, yet there’s no evidence of mixed customer funds. Moreover, KuCoin reportedly has sufficient reserves to meet withdrawal demands, providing a sense of stability in turbulent times.

This reassurance from industry observers highlights the resilience of KuCoin amidst the scrutiny. As the cryptocurrency market matures, the focus on compliance and standardization becomes increasingly important. KuCoin’s current situation reflects the broader challenges and opportunities facing the crypto industry as it seeks to align with regulatory expectations while fostering innovation and growth.