In crypto, this means that if you do not have private keys for your crypto, you are not the one who is in control of it. Recently, we saw many suffering from learning the lesson the hard way. The fall of FTX took billions of users’ funds and reminded everyone about the value in the self-custody of funds and the risks of trusting centralized entities.

Media has tagged this the end of crypto, saying let crypto burn, while regulators are speeding up tough measures on operating crypto entities. Many say that the fallout of FTX is very damaging to crypto, proving that this industry is not to be trusted and can collapse at any minute.

But let’s take a step back. What is crypto? The nascence of crypto goes to Bitcoin; a reminder of what it is: a purely peer-to-peer version of electronic cash that would allow online payments to be sent directly from one party to another without going through a financial institution.

Let that sink in. ‘Without going through a financial institution. The intrinsic features of blockchain technology and cryptography enable users to hold their funds in self-custody and transact peer-to-peer, without going through an intermediary.

So where does the FTX fiasco leaves the crypto ecosystem? Does this really bring the death of crypto, or will this push forward on-chain activities, DeFi, self-custody, and trust in code? Let’s dive in.

FTX

Billions of users’ funds are gone with the fall of FTX. Other entities providing centralized crypto services (CeFi) are affected due to exposure to FTX and some have to close their shops. Although FTX was in the crypto industry, this is not a crypto failure.

It is human failure, human greed, manual obfuscation of transactions, and manual theft of customers’ funds. It is about a human being manipulative and charming, earning trust by portraying a desirable image, while in the meantime conducting one of the biggest scams in crypto and finance.

People bought the product- Sam Bankman-Fried. People liked the image that he created, the cover of Forbes, a geek philanthropic billionaire who is a genius, with powerful new friends. Many wanted to touch a part of his empire, be part of it- he was trusted not only by average crypto retail users but also by experienced investors, influential funds, and High Net Worth individuals.

Those who trusted Sam Bankman-Fried were betrayed. But were they betrayed by crypto and by blockchain technology?

CeFi

Blockchain technology is decentralized, permissionless, and trustless technology that is inherently transparent at all times. The crypto industry has developed in a way that many centralized entities have set up offering services to acquire, trade, exchange and manage custody of crypto. The centralized crypto exchanges (CEXs) have made a big impact on the industry by onboarding and educating new users, providing easy access and exposure to crypto.

However, in a centralized entity, there is always a human error risk no matter how many controls are put in place. There will always be a person holding the private keys. There is always a risk that a human might fail, in many ways more than one. In centralized entities, it is humans who have access, control, and manage data; there is a human error risk at all levels.

Moreover, there is no transparency in centralized entities. Whenever a retail user or an institutional player puts the funds into a centralized exchange or a CeFi entity, all you can see afterward are numbers on the screen. In reality, it is not clear what is happening to the funds, as was demonstrated by the story of FTX. Right now, Sam Bankman-Fried is telling that he was willingly, unwillingly, knowingly, or unknowingly- he tampered with customers’ money, created FTX’s own currency FTT, took leverage against it, and did various acrobatics that were, and still are unknown to the users of FTX.

After the collapse of FTX, many crypto exchanges started publishing Proof of Reserves, seeking to show transparency of their reserves and balance sheet. This is certainly a welcoming gesture, although users should demand a regular PoR review. Also then, there is a risk of creative accounting, and human interference, and you do not get a clear view of Proof of Liabilities.

DeFi

Decentralized Finance (DeFi), which is based on blockchain, is a step up that brings transparency to the whole financial system. DeFi provides an immutable contract code that can govern and provide transparency for finance. In DeFi, everything happens on the blockchain according to the rules of code. The transactions are transparent, the balance sheet for lending or trading, and Proof of Reserves, are all publicly accessible to anyone with an internet connection.

In DeFi, protocol mechanisms and products are transparent by default to the nature of blockchain. All actions can be seen on-chain, they are defined by code and are executed accordingly. In DeFi, code is the law, it has no bias and it operates as it is written.

We can encode the rules of the exchange on the blockchain and enable for the trade to be executed, ensuring that the parties have custody of their tokens. When interacting with DeFi protocols, users are always in self-custody of their funds. Furthermore, cryptography gives ways to provide individuals privacy while enabling them to interact with a transparent public ledger.

Today, DeFi poses its own set of risks. The ecosystem is yet to mature and has a lot of space to grow. A code can be written wrongly, and these are mistakes that can be corrected with better code. There is always a smart contract risk, with which users interact, and this must be verified carefully. Also, platform risk, protocol mechanism failures, and bottlenecks can be expected in this developing ecosystem.

Nevertheless, the past year has been a good test for DeFi protocols which proved their resilience in tense and unpredictable crypto and macro environment. Leading DeFi money market protocols Aave and Compound continued serving the markets, while a plethora of new DeFi applications were being built on various blockchains.

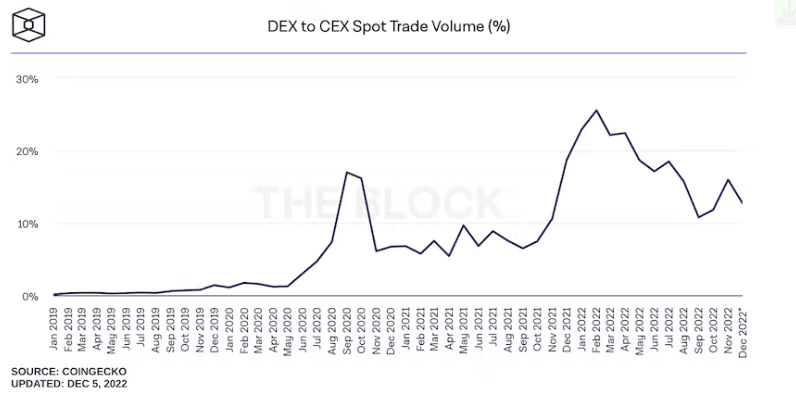

What concerns crypto trading, centralized exchanges have been leading the way in terms of onboarding new users and providing comprehensive tools for trading. Today, centralized exchanges still take the majority of the trading volume. However, the emergence of decentralized exchanges broke the dominance of CEXs and started a new era of permissionless, open, transparent, and efficient blockchain trading.

It is true that DEXs still lacks features that are available on centralized exchanges, also, on-chain trading tended to be slow and gas-expensive, depending on the blockchain.

There was an absence of limit orders functionality on DEXs, although this limitation has been solved by new generation DEXs that are coming to the ecosystem, like DeGate DEX.

Is the future DeFi?

CeFi was convenient and many retail and institutional crypto users trusted CeFi services and were used to the white glove service that those entities provided.

Together with FTX, other crypto CeFi players have started to fall- Genesis, BlockFi, etc. These were the entities that served institutional crypto players and provided institutional-level lending and other services. This leaves not only retail users damaged by the failures of centralized entities but also institutional players as well.

Retail users, who remain in crypto, are reminded of self-custody and are shifting towards using DEXs and DeFi platforms. Using centralized exchanges was convenient due to the features they provided and the user-friendly interface. However now, blockchain technology has advanced enough to provide similar trading features on decentralized exchanges as on CEXs.

What concerns borrowing and lending markets? DeFi is more accessible to retail users than similar services provided by CEXs. DeFi is permissionless and available to anyone with internet access around the world.

Institutional players tend to be very capital efficient and seek transparency. Now, when the rates are cheaper in DeFi than CeFi, why should they use CeFi? Why would you expose yourself to a risk of a centralized party, no matter how strong the backing of it is, if you don’t have to?

DeFi is leading the way with transparency, loan underwriting, and risk. Underwriting is more advanced on-chain, oracles can tell what the balance sheet is doing at all times without exposing the positions. Sure, DeFi has yet to develop and mature, but it is already much more transparent and secure than CeFi due to the intrinsic properties of blockchain and cryptography.

Decentralized exchanges have advanced together with technology. Today, a lot of attention is being paid to computations on Layer 2 and the use of Zero-Knowledge technology. All of this is significantly increasing the throughput of DEXs at a minimal gas cost and also bringing transaction matching capabilities to another level. Order Book, Limit Order trading is already possible on decentralized exchanges, which mostly used AMM (Automated Market Maker) mechanisms before, for instance, Uniswap.

DEXs are inherently transparent- all actions can be disclosed to the community whether it is a DAO buyback, public sale, or token conversion. Professional market makers have already started to pay more attention to DEXs as it is a huge open market with low custodian risk and new arbitrage market opportunities.

Following the failures of FTX and other CeFi failures, the industry is moving forward and keeps building. The market participants need to take self-custody seriously and use the possibilities of technology. Smart contract code is already a regulation itself and the whole ecosystem is governed by code. Contrary to the closed books of centralized entities, Defi has full transparency.

Blockchain provides tools for a decentralized, permissionless, trustless, and transparent financial ecosystem. While it might be difficult to make changes after being used to the centralized financial systems, eventually, people and firms are going to move where their capital is most efficient and secure.